Why Software Accounting AI is a Must-Have for Small Businesses in 2025?

What is Software Accounting AI and why is It Gaining Popularity?

Software accounting AI refers to the integration of artificial intelligence technologies into accounting software to automate, streamline, and enhance financial management processes. It combines traditional accounting systems with AI-driven tools such as machine learning, natural language processing, and predictive analytics to perform complex tasks with greater speed and accuracy.

Evolution of Accounting through Technology

Historically, accounting was a manual, paper-intensive task that gradually transitioned to digital spreadsheets and software systems. Over the last decade, the adoption of AI in accounting has evolved rapidly. From simple data entry automation to intelligent fraud detection and real-time financial forecasting, software accounting AI is reshaping how businesses manage their financial operations.

Why AI is Gaining Ground in Financial Processes

AI’s growing popularity in the accounting space is largely driven by its ability to save time, reduce human error, and increase efficiency. By automating repetitive tasks like invoice processing, expense categorization, and bank reconciliation, accounting AI frees professionals to focus on higher-value activities such as strategic planning and financial analysis.

Moreover, AI algorithms can analyse large datasets to uncover trends, identify anomalies, and make real-time recommendations. This enhances decision-making and supports better compliance with regulatory standards. The integration of AI also allows businesses to scale their operations without significantly increasing overhead costs.

A Transformative Shift in Finance

As companies increasingly look to digital transformation, it is becoming a critical tool for maintaining accuracy, efficiency, and competitiveness in today’s fast-paced business environment. Its popularity is expected to grow as more organizations recognize its value in streamlining operations and gaining deeper financial insights.

How Does Accounting AI Software Help Small Businesses Save Time and Money?

Accounting AI software is transforming how small businesses handle their financial operations by automating routine tasks, enhancing accuracy, and significantly reducing costs. As companies look to streamline workflows, AI-powered tools have become an essential part of modern financial management.

Automation of Invoicing, Payroll, and Bookkeeping

One of the main benefits of software accounting is its ability to automate repetitive tasks such as invoice generation, payroll processing, and day-to-day bookkeeping. This eliminates the need for manual data entry, reducing the likelihood of human error and freeing up valuable time for business owners and accounting teams. AI ensures that transactions are recorded promptly and accurately, improving overall efficiency.

Real-Time Financial Reporting and Error Reduction

With accounting AI software, small businesses can access real-time financial reports that offer a clear view of cash flow, profit margins, and other key metrics. AI algorithms also identify discrepancies and anomalies in transactions, helping to catch and correct errors early. This leads to better compliance, reduced risk of costly mistakes, and more informed decision-making.

Reduction of Manual Workloads and Operational Costs

By minimizing the need for extensive manual oversight, software accounting and AI lowers labour costs and allows small businesses to operate with leaner teams. Additionally, AI tools can handle high volumes of transactions without fatigue, ensuring scalability as the business grows. These cost savings can then be reinvested in core areas like marketing, product development, or customer service.

Smarter Finances for Growing Businesses

In today’s competitive market, small businesses need every advantage they can get. Adopting accounting AI software provides them with the tools to manage finances more intelligently, save time, reduce errors, and cut unnecessary expenses—making it a strategic move toward sustainable growth.

Why is Software Accounting AI Ideal for Non-Accountants?

Software accounting AI is revolutionizing the way individuals without formal financial training manages business finances. Designed with user-friendliness in mind, AI-powered accounting tools eliminate complexity and empower entrepreneurs, freelancers, and small business owners to take control of their finances confidently.

Intuitive Interfaces and Natural Language Processing

Traditional accounting software often intimidates non-accountants with technical jargon and complex workflows. In contrast, software accounting AI platforms are built with intuitive, user-friendly interfaces. Many tools now incorporate natural language processing, allowing users to interact with the system using plain language. This means users can ask questions like “How much did I spend on marketing last month?” and get accurate, understandable answers without needing to navigate confusing reports.

Smart Suggestions and Easy Dashboards

AI-driven tools offer smart features such as auto-categorization of transactions, predictive cash flow alerts, and personalized financial insights. These capabilities simplify bookkeeping and financial tracking, enabling non-accountants to manage budgets and monitor performance with minimal effort. Visually rich dashboards present data in a clear, digestible format, helping users make informed decisions quickly.

Guided Compliance and Tax Assistance

One of the most stressful aspects of managing finances is ensuring compliance and preparing for tax season. Software accounting AI assists users by flagging deductible expenses, tracking tax deadlines, and guiding users through filing requirements. These features reduce reliance on outside accountants and lower the risk of errors or penalties.

Empowering Everyday Users

In short, it makes financial management accessible to everyone—not just trained professionals. With smart automation, simple interfaces, and guided tools, it empowers non-accountants to handle their books accurately and efficiently, giving them greater control and confidence in running their businesses.

What Key Features Should Small Businesses Look for in Accounting AI Software?

Choosing the right accounting AI software is crucial for small businesses aiming to optimize their financial management. With many options available, understanding the key features to prioritize can help businesses select a solution that truly meets their needs.

Seamless Integration with Banks, POS, and E-commerce Platforms

One of the most important features small businesses should look for is seamless integration with external systems like banks, point-of-sale (POS) systems, and e-commerce platforms. This connectivity enables automatic transaction imports, real-time reconciliation, and unified financial reporting, reducing manual entry and saving valuable time.

Predictive Analytics and Financial Forecasting

Advanced accounting AI software offers predictive analytics capabilities that allow businesses to forecast cash flow, revenue, and expenses. These insights empower business owners to make proactive financial decisions, plan budgets effectively, and prepare for future growth. By leveraging AI-driven forecasting, companies can reduce financial uncertainties and optimize resource allocation.

AI-Driven Fraud Detection and Anomaly Alerts

Security is a top priority when dealing with financial data. Leading accounting AI solutions include intelligent fraud detection that continuously monitors transactions to identify unusual patterns or anomalies. Real-time alerts notify business owners immediately, helping prevent potential fraud and ensuring the integrity of financial records.

Scalable Pricing and Cloud Accessibility

Small businesses require software that can grow with them. Flexible, scalable pricing models allow companies to pay only for the features they need and upgrade as their operations expand. Cloud-based accessibility is also vital, enabling users to manage finances from anywhere, collaborate with accountants remotely, and benefit from automatic updates and backups.

Choosing the Right Solution

By focusing on these key features, small businesses can select accounting AI software that enhances efficiency, strengthens financial security, and supports sustainable growth—making it an indispensable tool in today’s competitive marketplace.

Which Industries Benefit Most from Software Accounting AI?

Software accounting AI is revolutionizing how different industries manage their finances, offering tailored solutions that address unique challenges and improve operational efficiency. Here are some of the key sectors that benefit the most from AI-driven accounting technologies.

Retail: Inventory and Sales Tracking with Financial Insights

Retail businesses rely heavily on accurate inventory management and sales tracking. AI-powered accounting software integrates these functions to provide real-time financial insights. This enables retailers to optimize stock levels, reduce waste, and make informed purchasing decisions. The automation of sales data processing helps improve profit margins and streamline overall business operations.

Freelancers and Consultants: Simplified Expense Tracking and Invoicing

For freelancers and consultants, managing expenses and generating invoices can be time-consuming and prone to error. AI-driven accounting tools simplify these tasks by automatically categorizing expenses and creating professional invoices. This not only saves time but also ensures timely payments and better cash flow management, allowing independent professionals to focus more on their core work.

Hospitality: Labor Cost Management, Forecasting, and Cash Flow Analysis

The hospitality industry benefits from AI’s ability to analyze labor costs and forecast demand accurately. AI accounting software helps hotels, restaurants, and other hospitality businesses optimize staffing schedules, control expenses, and improve cash flow through detailed financial analysis. This ensures better budgeting and maximizes profitability in a competitive market.

E-commerce: Real-Time Tax Calculations and Order-Profit Mapping

E-commerce businesses face complex tax regulations and order fulfilment challenges. AI software automates real-time tax calculations and maps profits per order, ensuring compliance and reducing errors. This automation allows e-commerce operators to focus on scaling their businesses while maintaining accurate financial records.

Empowering Diverse Industries

Across these industries, software accounting AI provides vital support for smarter financial management, boosting productivity and reducing manual workload.

How Does Accounting AI Software Improve Accuracy and Compliance?

Accurate financial data and regulatory compliance are critical for every business. Accounting AI software plays a significant role in enhancing both, reducing risks, and ensuring smoother financial operations.

Minimizing Human Error and Data Duplication

One of the primary advantages of accounting AI software is its ability to drastically reduce human error. Manual data entry is prone to mistakes such as typos, miscalculations, or duplicate records. AI automates these processes, ensuring data is entered correctly and consistently. This not only improves the accuracy of financial statements but also saves valuable time for accountants and business owners.

Automated Tax Calculations and Timely Reminders

Compliance with tax laws can be complex and ever-changing. AI-driven accounting software automates tax calculations based on the latest regulations, minimizing the risk of miscalculations or missed deductions. Additionally, the software provides timely reminders for tax filing deadlines and payments, helping businesses avoid costly penalties and maintain good standing with tax authorities.

AI-Assisted Audit Trails and Record-Keeping

Maintaining transparent and thorough records is essential for audits and compliance checks. Accounting AI software generates detailed audit trails, documenting every transaction and change automatically. This not only simplifies internal and external audits but also ensures accountability and traceability, which are vital for regulatory compliance.

Building Confidence in Financial Management

By integrating these features, businesses benefit from more accurate financial data and robust compliance mechanisms. The use of accounting AI software ultimately builds trust among stakeholders, reduces legal risks, and allows companies to focus on growth with peace of mind.

How Can Small Business Owners Learn to Use Software Accounting AI Effectively?

For small business owners, mastering software accounting AI is essential to streamline financial operations and stay competitive in today’s digital economy. Developing the right skills can unlock the full potential of AI-driven accounting tools.

Importance of AI and Digital Literacy

Understanding the basics of AI and digital tools is the first step toward effective use of accounting software. AI literacy enables business owners to navigate features such as automation, predictive analytics, and error detection confidently. Improving digital literacy also reduces reliance on external help, saving costs and increasing operational efficiency.

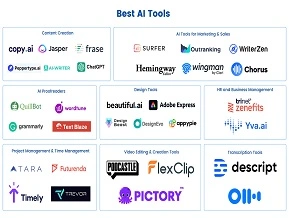

Role of LAI in Offering Online AI Courses for Business Use Cases

The Learning AI (LAI) platform plays a pivotal role in educating small business owners about AI applications relevant to their operations. LAI offers accessible online courses that focus on real-world business use cases, helping learners understand how to implement software accounting AI for tasks like invoicing, payroll, and tax compliance. These courses are designed to bridge the gap between technology and practical business needs.

Courses and Tutorials Tailored to Non-Technical Professionals

Recognizing that many small business owners may not have a technical background, LAI provides tutorials and learning paths tailored specifically for non-technical users. The step-by-step instructions and hands-on projects simplify complex concepts, making it easier to adopt AI tools confidently. This approach accelerates learning and empowers owners to make data-driven decisions based on accurate financial insights.

Empowering Small Businesses

By investing in AI and digital literacy through platforms like LAI, small business owners can maximize the benefits of software accounting AI. This not only improves financial accuracy and compliance but also drives long-term business growth and resilience.

Conclusion

In 2025, software accounting and AI is no longer optional but essential for small businesses aiming to save costs, boost efficiency, and make smarter financial decisions. The shift toward AI-led business tools is transforming how companies manage accounting and compliance, offering real-time insights and automation. To stay competitive and future-proof their operations, small business owners are encouraged to start learning with LAI’s online AI programs. These courses provide the knowledge and skills needed to harness AI’s power effectively, making it easier to adapt and thrive in a rapidly evolving digital landscape.