How Machine Learning in Finance is Changing the Way We Invest and Trade?

Is Machine Learning in Finance Creating a Data-Driven Revolution?

The Rise of Financial Data and Intelligent Analytics

In today’s fast-paced financial markets, machine learning in finance is transforming the way analysts and institutions make decisions. With the explosion of structured and unstructured data—from market feeds and financial statements to social media sentiment—traditional methods often fall short in identifying patterns, anomalies, or future trends. Financial professionals are now turning to machine learning to efficiently process and interpret vast datasets in real time.

Unlocking Insights from Complex Financial Datasets

Machine learning algorithms, such as decision trees, neural networks, and support vector machines, are uniquely equipped to identify hidden correlations within complex datasets. These models learn from historical data and continuously adapt as new information becomes available. Whether it’s predicting stock price movements, assessing credit risk, or detecting fraudulent transactions, machine learning provides powerful tools that go beyond surface-level analysis.

Traditional Models vs. Machine Learning Approaches

Traditional financial models typically rely on linear relationships, assumptions of normality, and predefined equations. While these methods are valuable, they can struggle with non-linear patterns and large-scale data. In contrast, machine learning-driven approaches are data-first and model-free. They can dynamically adjust to market changes, making them more robust in volatile environments. For instance, while a traditional model might fail to capture the impact of sudden geopolitical events, a machine learning model trained on a broader data spectrum—such as news feeds and social sentiment—can detect such signals more quickly.

As financial ecosystems become increasingly digital and complex, the integration of it offers a competitive edge. It empowers institutions to make faster, more informed decisions and adapt to changing market dynamics with agility. The future of finance is undoubtedly data-driven, and machine learning is at the core of this transformation.

How Machine Learning in Finance is Reshaping Trading Practices?

High-Frequency Trading: Speed Meets Intelligence

One of the most profound ways that machine learning and finance intersect is through high-frequency trading (HFT). In HFT, algorithms execute thousands of trades within seconds, capitalizing on minute price discrepancies. Machine learning models enhance this process by identifying patterns in historical price movements and predicting short-term trends with greater accuracy. These models continuously evolve, allowing traders to refine strategies in real time and gain a competitive edge.

Sentiment Analysis and Predictive Power

Markets are not driven solely by numbers—they react to news, events, and public sentiment. Machine learning algorithms can now analyse vast streams of unstructured data such as social media posts, earnings reports, and real-time news articles. Natural Language Processing (NLP), a branch of machine learning, is especially useful in interpreting sentiment and gauging its potential impact on market movements. For example, a sudden surge in negative sentiment about a company can signal an impending drop in its stock price, giving traders valuable time to act.

Real-World Applications on Trading Floors

Case studies from top investment banks and hedge funds highlight the real impact of machine learning on trading practices. Firms like JPMorgan Chase and Renaissance Technologies use machine learning models to inform trading decisions, manage risk, and automate trade execution. These models ingest massive amounts of market data, learn from past market behaviour, and adjust strategies accordingly. On modern trading floors, human intuition is increasingly complemented by algorithmic precision.

The fusion of it is redefining how trading is conducted. By enabling faster, smarter, and more adaptive decision-making, machine learning is no longer just an advantage—it’s a necessity. As the financial landscape continues to evolve, the role of machine learning will only become more central in shaping the future of trading.

How are Machine Learning and Finance Delivering Smarter Portfolio Management?

Predictive Analytics for Smarter Asset Performance

The integration of machine learning and finance is revolutionizing portfolio management by enabling more accurate predictions of asset performance. Traditional models rely heavily on historical returns and fixed financial indicators, but machine learning takes a broader and more nuanced approach. By analysing large volumes of diverse data—such as market trends, macroeconomic indicators, and even social sentiment—machine learning models can forecast asset behaviour with improved precision. This empowers investors to anticipate market shifts and rebalance their portfolios proactively.

Dynamic Asset Allocation in Real Time

Unlike static allocation models, machine learning supports dynamic asset allocation by continuously adjusting portfolio weights in response to changing market conditions. Algorithms monitor real-time data feeds and can recognize when certain asset classes are becoming more or less favourable. This agility allows portfolio managers to respond swiftly to volatility, economic cycles, or geopolitical events, thereby optimizing risk-adjusted returns. Dynamic allocation powered by machine learning reduces reliance on periodic reviews and manual rebalancing, resulting in smarter and more efficient portfolio strategies.

Active vs. Passive Strategies in the Age of AI

Machine learning is reshaping the debate between active and passive investment strategies. In active management, machine learning tools are being used to uncover hidden opportunities, exploit market inefficiencies, and generate alpha. On the other hand, passive strategies are also benefiting as ML models refine index tracking and improve risk control through better ETF and index construction. Whether investors prefer an active or passive approach, machine learning offers enhancements that improve decision-making and performance across the board.

The collaboration of it is making portfolio management more predictive, responsive, and personalized. As investors seek to maximize returns while managing risk, adopting machine learning tools is quickly becoming essential for success in today’s dynamic financial landscape.

How is Machine Learning in Finance Transforming Risk, Compliance, and Fraud Prevention?

Automating Compliance in a Complex Regulatory Landscape

In the heavily regulated financial sector, it is playing a critical role in streamlining compliance processes. Traditional compliance systems often rely on rule-based frameworks that can be time-consuming and inflexible. Machine learning, however, enables automated monitoring of transactions, communications, and reports, helping institutions detect irregularities and flag potential violations more accurately. These systems continuously learn from new data, reducing false positives and adapting to evolving regulations—saving time, money, and reputational risk.

Fighting Financial Crime: AML and Fraud Detection

Machine learning has become an essential tool in the fight against money laundering and fraud. By analysing historical transaction data, customer behaviour, and network patterns, ML algorithms can detect anomalies that may indicate fraudulent activity. These tools go beyond simple rule violations, identifying subtle and complex behaviours typical of modern financial crimes. Anti-money laundering (AML) systems powered by machine learning can also prioritize alerts based on risk levels, enabling faster investigation and response by compliance teams.

Credit Scoring and Risk Assessment Revolutionized

Assessing creditworthiness has traditionally relied on static credit scores and basic financial history. Machine learning brings a transformative shift by incorporating alternative data sources such as payment behaviour, employment history, online activity, and more. These models provide a more holistic and accurate view of a borrower's financial health. As a result, financial institutions can offer fairer, more personalized credit assessments and make better-informed lending decisions, especially for underbanked or thin-file customers.

The application of it is transforming how institutions manage risk, enforce compliance, and combat financial crime. From real-time fraud detection to dynamic credit scoring, machine learning is enabling smarter, faster, and more secure financial operations across the industry.

How are Machine Learning and Finance Enhancing the Personalized Finance Experience?

Customized Banking and Wealth Management

One of the most user-facing impacts of machine learning and finance is the rise of hyper-personalized banking and wealth management services. By analysing customer transaction history, financial goals, and lifestyle patterns, machine learning algorithms can offer tailored financial products, suggest saving plans, and even automate budgeting. This personalization improves customer satisfaction and loyalty, as users feel their financial needs are understood and proactively supported.

Behavioural Finance Meets AI

Machine learning is also transforming the field of behavioural finance by recognizing individual habits and biases in decision-making. Financial institutions can now provide investment recommendations that align not only with a customer’s risk profile and financial goals but also with their behavioural tendencies. For example, an algorithm may detect that a user is prone to panic-selling during market dips and offer timely nudges or alternative strategies to mitigate impulsive decisions. These insights help users stay on track with long-term goals, making investment management both smarter and more human-centric.

Smart Assistants and AI-Powered Interactions

The integration of chatbots, voice AI, and digital financial assistants is revolutionizing how users interact with their finances. These intelligent tools can answer queries, schedule bill payments, alert users to unusual spending, and even guide them through investment options—all in natural language. Machine learning enhances these assistants by allowing them to learn from past interactions, continuously improving the relevance and accuracy of their responses. This creates a seamless, conversational experience that makes managing money easier and more engaging.

By combining the strengths of it, the financial industry is delivering highly personalized and intuitive experiences. From tailored advice to smart automation, users are benefiting from services that not only respond to their needs but anticipate them—ushering in a new era of customer-centric finance.

What are the Challenges of Machine Learning in Finance: Accuracy, Ethics, and Oversight?

Data Quality and Model Interpretability

As powerful as machine learning in finance can be, it faces significant hurdles—starting with the quality and reliability of data. Financial data can be noisy, incomplete, or biased, leading to inaccurate predictions and flawed insights. Additionally, many machine learning models, especially deep learning networks, operate as “black boxes,” making it difficult for stakeholders to understand how decisions are made. In a domain where transparency is critical, this lack of interpretability can undermine trust and hinder adoption among financial professionals and regulators.

Ethics: Fairness, Bias, and Transparency

Ethical concerns are at the forefront of deploying it. Algorithms trained on biased historical data can unintentionally perpetuate discrimination, especially in areas like credit scoring, loan approvals, or insurance pricing. Without careful oversight, these models may favour certain demographic groups while disadvantaging others. Ensuring fairness requires continuous auditing, transparent design, and inclusive datasets. Moreover, customers and regulators increasingly demand clear explanations for automated decisions—a challenge for systems that prioritize predictive power over interpretability.

Regulatory Challenges and Auditability

The regulatory landscape for financial machine learning systems is still evolving. Financial institutions must demonstrate that their models comply with data protection laws, anti-discrimination standards, and risk management requirements. This is difficult when machine learning models are dynamic and constantly learning from new data. Regulators also require auditability—clear documentation of how a model works, what data it uses, and how decisions are reached. Achieving this balance between innovation and compliance remains a complex task for organizations worldwide.

While the integration of it offers substantial benefits, it also introduces new risks and responsibilities. Overcoming challenges related to data quality, ethics, and regulation is essential to building trustworthy and effective ML systems. Responsible implementation is the key to long-term success and widespread adoption in the financial industry.

What is the Future Holds for Machine Learning in Finance?

AI, Blockchain, and the Rise of Decentralized Finance

The future of machine learning in finance is increasingly intertwined with cutting-edge technologies like blockchain and decentralized finance (DeFi). As DeFi platforms grow, there is a rising need for intelligent systems to manage risk, detect fraud, and automate smart contract execution. Machine learning can analyse on-chain data to assess user behaviour, predict token volatility, and enhance security in peer-to-peer transactions. The fusion of AI and blockchain holds the potential to make financial systems more secure, transparent, and autonomous.

Explainable AI for Trust and Regulation

As financial regulators push for greater transparency and accountability, the evolution of Explainable AI (XAI) is set to become a major force in the adoption of machine learning. In contrast to opaque black-box models, XAI focuses on making decisions understandable to humans—whether they are regulators, auditors, or consumers. This is particularly important in sectors like banking, insurance, and investment, where stakeholders need to verify that algorithms are fair, unbiased, and compliant with legal standards. XAI will play a key role in bridging the gap between innovation and regulatory acceptance.

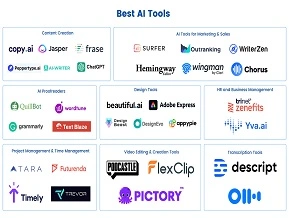

A Promising Landscape for Careers and Learning

The growing reliance on it is also creating abundant opportunities for professionals and aspiring learners. Financial institutions are actively seeking data scientists, quantitative analysts, and AI specialists who can design, interpret, and manage advanced models. For students and mid-career professionals, this is an ideal time to explore upskilling through AI and finance-related certifications, degrees, and online programs. The intersection of finance and machine learning offers not just technical challenges but also meaningful ways to shape the future of the global economy.

The future of it is dynamic, decentralized, and driven by the demand for transparency and innovation. As the industry evolves, so too will the opportunities for professionals, institutions, and consumers to benefit from smarter, more inclusive financial systems.

Conclusion

From predictive analytics in investing to fraud detection and personalized financial services, machine learning in finance is driving a fundamental shift in how the financial industry operates. As this transformation accelerates, the ability to understand and apply these technologies is becoming crucial. Professionals who grasp the power of machine learning and finance will be better positioned to innovate, lead, and adapt in an increasingly data-driven environment. To stay ahead, building AI literacy is essential. Explore online courses at LAI to gain the practical skills needed to shape your future in the evolving world of finance.