How the Finance Industry in AI is Driving Automation and Smarter Decisions?

What Does the Finance Industry in AI Look Like Today?

The finance industry in AI is undergoing a transformative shift, leveraging cutting-edge technologies to enhance accuracy, efficiency, and decision-making. From automating routine tasks to making real-time predictions, artificial intelligence is helping financial institutions deliver smarter services at lower costs.

Integration of AI Across Finance

Artificial intelligence is now deeply integrated into several financial functions. In banking, AI is used to streamline customer service through chatbots, detect fraud using pattern recognition, and personalize offerings through customer data analysis. In investment and asset management, AI-powered algorithms help analyse massive data sets to forecast market trends, execute trades at high speeds, and manage portfolios with minimal human intervention.

Key Areas of Adoption

- Banking: AI helps detect fraud, assess credit risk, and improve customer experiences through natural language processing and predictive analytics.

- Investment: Robo-advisors and quantitative trading strategies are powered by AI, offering algorithmic decisions based on real-time market data.

- Insurance: AI assists with claims processing, underwriting, and customer service automation, enhancing accuracy and reducing turnaround time.

- Risk Management: AI models are used to identify and predict financial risks, allowing firms to take preventive actions and remain compliant with regulations.

Market Growth and Future Outlook

The global AI in finance market is expanding rapidly. Valued at billions today, it is expected to grow significantly in the coming years due to increased digital transformation and demand for real-time analytics.

How is AI in the Finance Industry Automating Core Processes?

The AI in finance industry revolution is transforming how institutions manage daily operations, especially in the realm of automation. By introducing intelligent technologies like Robotic Process Automation (RPA) and machine learning, financial institutions are reducing costs, eliminating errors, and accelerating workflows that were once time-consuming and manual.

Streamlining Back-Office Operations with RPA

Robotic Process Automation (RPA) has become a key tool in automating repetitive tasks within finance. From reconciling transactions to processing invoices and updating customer records, RPA bots operate with precision and consistency. These bots handle high-volume tasks without fatigue, freeing up human employees to focus on more strategic, value-added roles.

Automating Data Entry and Document Workflows

One of the most impactful areas of automation is data management. AI-powered systems can now extract, analyse, and validate information from financial documents such as loan applications, tax forms, and compliance reports. Natural language processing (NLP) enables systems to interpret unstructured text, reducing the need for manual entry and review. These technologies ensure faster processing times and increased data accuracy.

Enhancing Compliance and Reducing Costs

Compliance is critical in finance, and AI helps ensure that regulations are followed automatically. Automated systems track rule changes, monitor transactions, and generate audit trails in real-time. By minimizing manual oversight, financial institutions not only reduce the risk of non-compliance but also lower operational costs. Additionally, automation reduces human error, which is one of the most common sources of costly mistakes in financial services.

As adoption of this operations continues to grow, institutions are reaping the benefits of faster service delivery, improved accuracy, and enhanced operational resilience.

How is AI in the Finance Industry Enhancing Risk Management and Fraud Detection?

The AI in finance industry evolution is significantly enhancing how financial institutions manage risk and detect fraud. By using real-time data, machine learning models, and advanced analytics, AI empowers organizations to respond faster to threats, improve risk assessment accuracy, and safeguard assets more effectively.

Real-Time Monitoring and Predictive Analytics

Traditional risk management systems often rely on historical data and manual analysis, which can delay response times. AI changes this by enabling real-time monitoring of financial transactions and market behaviour. Predictive analytics uses past data to forecast future risks, allowing institutions to proactively manage potential issues like market volatility, customer default, or liquidity concerns.

Smarter Credit Scoring and Risk Profiling

AI-powered credit scoring goes beyond conventional methods by incorporating alternative data sources such as social media behaviour, mobile phone usage, and payment histories. These models can assess borrowers with limited credit history more accurately, enabling more inclusive lending. Risk profiling is also enhanced through AI algorithms that analyse customer behaviour, transaction history, and macroeconomic factors to assign more precise risk levels.

Detecting Fraud Through AI Pattern Recognition

Fraud detection has seen major advancements through AI. Machine learning models are trained to identify unusual transaction patterns, flag anomalies, and detect potential fraud in real-time. Whether it’s phishing attempts, identity theft, or card fraud, AI can spot suspicious behaviour much faster than traditional systems. This helps minimize financial losses and protect customer trust.

As the AI in finance industry continues to mature, its role in strengthening risk frameworks and fraud prevention will only become more central. The integration of intelligent technologies ensures not just faster response, but smarter, data-driven decision-making that enhances institutional resilience.

How is the Finance Industry in AI Enabling Smarter Investment and Trading Decisions?

it is reshaping how investment decisions are made, using intelligent systems to optimize portfolios, forecast market trends, and respond to economic shifts in real time. AI-driven tools are replacing traditional investment strategies with faster, more accurate, and data-centric methods.

Algorithmic Trading and AI-Powered Portfolio Management

One of the most prominent applications of AI in finance is algorithmic trading. These AI-based systems analyse market data at lightning speed, executing trades based on pre-set rules and real-time insights. This reduces human error and emotional bias while capitalizing on even the smallest market movements. In addition, AI enhances portfolio management by adjusting asset allocations based on changing risk profiles, market trends, and investor goals.

Sentiment Analysis with Natural Language Processing (NLP)

Investment strategies are no longer confined to numerical data. With natural language processing (NLP), AI tools can analyse massive volumes of unstructured text—news articles, social media posts, analyst reports—to gauge market sentiment. This allows investors to identify public mood and emerging trends before they are reflected in market prices. NLP-based sentiment analysis is becoming a key driver of proactive decision-making in asset management.

Predictive Models for Market Forecasting

AI’s ability to recognize complex patterns makes it ideal for financial forecasting. Predictive models can anticipate market fluctuations, economic shifts, and asset price movements using historical data and real-time inputs. These models help investors make more informed decisions and reduce exposure to unforeseen risks.

it is revolutionizing investment and trading by replacing traditional guesswork with data-backed intelligence. As these technologies continue to evolve, they promise more personalized, responsive, and efficient financial strategies for institutions and individual investors alike.

How is the Finance Industry in AI Delivering Personalised Financial Services and Customer Experience?

it is rapidly transforming customer service and financial advisory experiences. With intelligent systems now able to understand, predict, and respond to individual needs, financial institutions are offering more personalised, efficient, and accessible services than ever before.

AI-Powered Chatbots and Virtual Assistants

One of the most visible applications of AI in finance is the rise of chatbots and virtual assistants. These AI-driven tools are available 24/7 to help customers with tasks like checking balances, transferring funds, or answering policy queries. By using natural language processing (NLP), they understand and respond in human-like ways, improving both speed and satisfaction. This reduces the burden on human staff and ensures round-the-clock support.

Customer Profiling for Personalised Financial Advice

AI systems can analyse a customer's financial data, transaction history, and behavioural patterns to create detailed customer profiles. These profiles enable financial institutions to provide tailored recommendations—whether it's suggesting savings plans, investment opportunities, or credit options. Personalisation increases customer trust and loyalty by delivering advice that aligns with individual financial goals and life stages.

Enhancing Client Engagement with Intelligent Automation

Beyond chatbots, intelligent automation is enhancing customer journeys across digital channels. AI can trigger reminders for bill payments, alert users to suspicious activity, and even predict when a customer might need a loan or investment product. This proactive service approach improves engagement and makes financial services feel more responsive and intuitive.

As it continues to evolve, personalised financial services are becoming the new standard. By leveraging data, machine learning, and automation, financial institutions are able to build stronger relationships with their clients while streamlining their operations for greater efficiency.

What are the Challenges of Using AI in the Finance Industry?

While the finance industry in AI is advancing rapidly, it also faces significant challenges that must be addressed to ensure responsible and effective adoption. From regulatory hurdles to ethical concerns, deploying AI in financial systems requires careful planning and governance.

Regulatory Concerns and Ethical Risks

One of the biggest challenges is navigating the complex regulatory environment. Financial institutions must ensure that AI systems comply with regional and international laws, such as anti-money laundering (AML) and know your customer (KYC) requirements. Moreover, ethical risks arise when AI models make decisions that could lead to discrimination or unfair treatment—such as biased credit scoring or exclusionary lending practices. Regulators are increasingly focused on the fairness and accountability of AI algorithms.

Data Privacy, Transparency, and Explain ability

AI systems rely heavily on data—often sensitive customer and financial information. Ensuring data privacy and adhering to regulations like GDPR is a major concern. Additionally, many AI models, particularly deep learning systems, operate as “black boxes,” making it difficult to explain how decisions are made. This lack of transparency and explain ability can undermine trust, especially in areas like loan approvals, fraud detection, or investment advice where decisions must be justified.

Talent and Infrastructure Requirements

Deploying AI effectively requires both technical expertise and robust digital infrastructure. Many financial institutions face a shortage of skilled professionals who understand both AI and financial services. Additionally, implementing AI at scale demands high-performance computing systems, cloud-based platforms, and ongoing maintenance—all of which require significant investment.

While it offers immense potential, it must overcome regulatory, ethical, technical, and organizational challenges. Addressing these issues is critical to building trust, ensuring compliance, and unlocking the full value of AI in financial services.

What’s Next for the Finance Industry in AI?

The finance industry in AI is entering a new era, driven by emerging technologies, evolving regulations, and a growing emphasis on digital innovation. As AI capabilities become more advanced and accessible, they are set to reshape the financial landscape in profound and lasting ways.

Emerging Trends: Generative AI, Governance, and Quantum Computing

One of the most exciting trends is the adoption of generative AI in finance. These models can generate insightful financial reports, assist with predictive forecasting, and support customer service through advanced natural language generation. At the same time, institutions are increasingly focused on AI governance—creating ethical frameworks, bias mitigation strategies, and compliance mechanisms to ensure responsible use of AI. Another development on the horizon is the use of quantum computing, which could revolutionize complex financial modelling and risk analysis by processing massive datasets at unprecedented speed.

Long-Term Impact on Jobs and Organizational Structures

AI is expected to significantly reshape job roles in the finance sector. While automation may reduce the need for certain routine tasks, it will also create demand for new skills in data science, AI ethics, and algorithmic auditing. Traditional departments may become more integrated with technology teams, leading to more agile and data-driven organizational structures. Human expertise will continue to play a crucial role, especially in interpreting AI insights and making high-level strategic decisions.

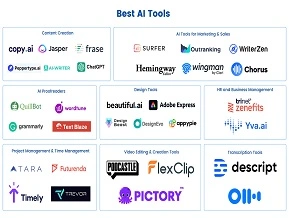

Importance of AI Education in Finance

As it evolves, the need for continuous learning becomes vital. Financial professionals must understand AI tools and their implications, from data privacy to ethical use. Educational initiatives—both in-house training and external AI courses—will be essential for preparing the workforce and ensuring that the future of finance is both innovative and responsible.

Conclusion

The finance industry in AI is rapidly evolving, bringing transformative changes across banking, investment, insurance, and risk management. From automation and fraud detection to personalised financial services and advanced forecasting, AI is reshaping the way finance operates. As the AI in finance industry continues to grow, it’s essential for finance professionals and students to develop a strong understanding of AI tools, ethical considerations, and practical applications. Embracing AI is not just a competitive advantage—it’s a necessity. To stay future-ready, individuals should explore AI courses and equip themselves with the skills needed to thrive in tomorrow’s financial landscape.