Finance Industry and AI: How Machine Learning Is Revolutionising Risk Analysis?

How is AI Transforming the Finance Industry?

The AI finance industry is rapidly transforming the way institutions operate, invest, and manage risk. From banking to asset management, artificial intelligence is no longer a futuristic concept but a current reality reshaping financial services worldwide. By automating complex processes, enhancing data analysis, and improving decision-making accuracy, AI technologies are becoming indispensable tools across the finance sector.

One of the most critical areas where AI is making a significant impact is risk analysis. In financial decision-making, accurately identifying, assessing, and mitigating risk is essential for long-term success and regulatory compliance. Traditional risk assessment methods, though effective to a degree, often fall short when faced with large volumes of unstructured data or rapidly changing market conditions. AI-driven systems, however, are capable of processing vast datasets in real time, detecting patterns that might go unnoticed by human analysts, and delivering faster, data-backed insights.

This shift has led to a growing reliance on machine learning, a branch of AI that enables systems to learn from data and improve their performance over time without explicit programming. Machine learning models are increasingly being used to forecast market trends, detect fraud, optimize portfolios, and conduct sentiment analysis using social media and news data. These models offer a level of adaptability and predictive power that traditional statistical tools cannot match.

As financial institutions strive to remain competitive and agile in a data-driven world, the integration of AI and machine learning is not just an option—it is a strategic necessity. The rise of AI in finance marks a pivotal shift in how financial decisions are made, driving more informed, efficient, and secure outcomes.

What is Financial Risk Analysis and why is Innovation Needed in the Finance Industry?

As the finance industry and AI continue to evolve together, one area that remains critical to institutional success is risk analysis. Financial risk analysis involves identifying potential threats to an organization’s assets, earnings, and operations due to market volatility, credit issues, operational failures, or external events. It plays a vital role in shaping investment decisions, regulatory compliance, and long-term business strategies.

What is Financial Risk Analysis?

Financial risk analysis is the systematic process of evaluating the likelihood and impact of negative financial events. It enables institutions to anticipate market shifts, prepare for economic downturns, and manage exposure to credit defaults or currency fluctuations. This analysis is central to maintaining financial health and protecting stakeholders' interests.

Traditional Approaches: Limitations and Inefficiencies

Historically, financial institutions relied on rule-based models, static risk scoring systems, and historical data to assess risks. While these methods offered a foundational approach, they often lacked flexibility and struggled with:

- Data Volume: Unable to process the vast and growing amounts of structured and unstructured financial data.

- Real-Time Decision-Making: Delays in data interpretation made them less effective in volatile market conditions.

- Predictive Power: Rigid models couldn't adapt to new risk factors or emerging patterns.

These limitations have led to increased vulnerability and missed opportunities in high-speed financial environments.

Why Innovation is Needed in a Rapidly Evolving Market?

Today’s finance sector is marked by rapid technological advancements, shifting regulations, and global interconnectedness. To remain resilient and competitive, institutions must adopt more dynamic and intelligent approaches to risk management. This is where the integration of advanced technologies particularly AI becomes essential.

By leveraging real-time data, adaptive algorithms, and predictive modelling, AI helps enhance the accuracy, speed, and scope of risk analysis.

How is AI Driving a Paradigm Shift in Risk Management Within the Finance Industry?

The ai finance industry is experiencing a profound transformation, especially in the realm of risk management. Artificial intelligence is reshaping traditional financial workflows by introducing advanced automation, enhanced data processing, and real-time decision-making capabilities. This shift is enabling institutions to better navigate the complexities and uncertainties of modern markets.

How is Artificial Intelligence Changing Financial Workflows?

AI is revolutionizing the way financial organizations operate by streamlining workflows that were once manual, time-consuming, and prone to error. Tasks such as data entry, risk assessment, and report generation are now increasingly automated through intelligent algorithms. This allows finance professionals to focus more on strategic analysis and less on routine operational work, improving overall efficiency and accuracy.

Automation of Data Collection and Processing

One of the most significant benefits AI brings to the finance sector is the automation of data collection and processing. Financial institutions handle enormous volumes of data daily, including market feeds, transaction records, and unstructured data such as news articles or social media sentiment. AI-powered tools can aggregate, clean, and analyse this data quickly, identifying relevant risk factors and anomalies without human intervention. This automation reduces the likelihood of errors and ensures that risk assessments are based on comprehensive and up-to-date information.

Real-Time Decision-Making Capabilities

The dynamic nature of financial markets demands rapid and informed decision-making. AI enables real-time risk analysis by continuously monitoring data streams and applying predictive models that adapt to changing conditions. This capability allows organizations to respond promptly to emerging threats, adjust their risk exposure, and capitalize on market opportunities. The finance sector is increasingly relying on these intelligent systems to maintain a competitive edge and ensure regulatory compliance in an evolving landscape. In summary, the integration of AI in finance marks a paradigm shift in risk management, making processes faster, smarter, and more reliable than ever before.

What are the Core Concepts of Machine Learning in Risk Analysis?

Machine learning (ML) has become a fundamental tool in modern risk analysis, offering powerful techniques to enhance prediction accuracy and decision-making in finance. Understanding the core concepts of ML and how they apply to financial risk management is essential for grasping its transformative impact.

What is Machine Learning (ML)?

Machine learning is a branch of artificial intelligence focused on developing algorithms that enable computers to learn from data and improve their performance over time without being explicitly programmed. Unlike traditional programming, where rules are hardcoded, ML models identify patterns and relationships within large datasets, making them especially valuable for complex, data-driven environments such as finance.

Supervised vs. Unsupervised Learning for Finance

ML techniques are generally categorized into supervised and unsupervised learning, both of which have important applications in risk analysis.

- Supervised Learning: This approach trains models on labelled datasets, meaning the input data includes known outcomes. For example, a supervised model might learn to predict whether a loan applicant will default based on historical credit data. Common supervised algorithms include decision trees and support vector machines.

- Unsupervised Learning: Here, models work with unlabelled data, seeking to identify hidden patterns or groupings without predefined outcomes. This is useful in finance for anomaly detection or clustering customers with similar risk profiles. Techniques such as clustering and principal component analysis (PCA) fall under this category.

Key Algorithms Used in Risk Modelling

Several ML algorithms are particularly effective in financial risk modelling:

- Decision Trees: These models split data into branches to make predictions based on feature values. They are intuitive and useful for credit scoring or fraud detection.

- Neural Networks: Inspired by the human brain, neural networks are powerful for capturing nonlinear relationships in large, complex datasets, making them suitable for market risk forecasting.

- Support Vector Machines (SVMs): Effective for classification tasks, SVMs help distinguish between risky and non-risky financial behaviours.

Machine learning is reshaping risk analysis by providing adaptive, data-driven insights that enhance accuracy and speed in the finance industry.

How is Machine Learning Revolutionising Risk Analysis in the Finance Industry?

Machine learning is rapidly transforming risk analysis within the finance sector by enhancing predictive accuracy, automating fraud detection, and improving credit evaluation processes. These innovations enable financial institutions to make smarter, faster, and more reliable decisions in an increasingly complex market environment.

Predictive Analytics for Market and Credit Risk

Machine learning models leverage vast datasets to perform predictive analytics, forecasting potential market fluctuations and credit defaults with higher precision than traditional methods. By analysing historical trends, economic indicators, and customer behaviour, these models help institutions anticipate risks before they materialize, allowing proactive risk mitigation strategies.

Fraud Detection Using Anomaly Detection Algorithms

Detecting fraudulent transactions is critical to maintaining trust and financial stability. Machine learning employs anomaly detection algorithms to identify unusual patterns in transaction data that deviate from normal behaviour. These algorithms can spot subtle signs of fraud in real-time, significantly reducing false positives and minimizing financial losses.

Customer Credit Scoring Improvements

Machine learning has revolutionized customer credit scoring by integrating diverse data sources such as payment histories, social media activity, and even mobile phone usage. This holistic approach enables lenders to better assess creditworthiness, extend credit responsibly, and reduce default rates. Models continuously learn and adapt, improving scoring accuracy over time.

Case Studies and Real-World Applications

Leading financial institutions have successfully integrated machine learning into their risk management frameworks. For example, JP Morgan uses ML-driven predictive models to assess credit risk and optimize portfolio management. PayPal employs advanced anomaly detection to identify fraudulent transactions swiftly, protecting millions of users globally. These real-world applications demonstrate the tangible benefits of machine learning in enhancing financial security and operational efficiency.

Overall, machine learning is revolutionizing risk analysis in the finance industry by providing dynamic, data-driven insights that empower institutions to manage risks more effectively and competitively.

What are the Benefits of AI-Powered Risk Analysis for the Finance Industry?

AI-powered risk analysis is revolutionizing the finance industry by delivering significant improvements in accuracy, speed, and regulatory compliance. Financial institutions leveraging AI technologies gain a competitive advantage by managing risks more effectively and efficiently.

Increased Accuracy and Reduced Human Error

One of the most significant benefits of AI in risk analysis is its ability to process vast amounts of data with high precision, minimizing the risk of human error. AI algorithms can detect subtle patterns and anomalies that might be overlooked by traditional methods or manual review. This leads to more accurate risk predictions and better-informed financial decisions, ultimately reducing costly mistakes.

Faster Risk Assessment and Decision-Making

AI automates the collection, processing, and analysis of financial data, enabling real-time risk assessments. This acceleration allows institutions to respond swiftly to emerging threats or market changes, maintaining agility in volatile environments. Faster decision-making supports timely portfolio adjustments and proactive risk mitigation strategies, which are critical in today’s fast-paced finance industry.

Enhanced Compliance and Regulatory Reporting

The finance industry faces increasing regulatory scrutiny, with complex reporting requirements designed to ensure transparency and stability. AI-powered systems can automatically track, analyse, and report compliance-related data, reducing the burden on human teams and minimizing errors in regulatory submissions. This not only ensures adherence to evolving standards but also helps avoid penalties and reputational damage.

In summary, AI-powered risk analysis enhances the finance industry by improving accuracy, speeding up decision processes, and strengthening compliance efforts, all of which contribute to more robust and resilient financial institutions.

What are the Challenges and Ethical Considerations in Using AI in Finance?

The integration of finance industry and AI brings immense potential but also raises important challenges and ethical considerations that must be addressed to ensure responsible and effective adoption.

Data Privacy and Security Concerns

AI systems in finance rely heavily on large volumes of sensitive data, including personal financial information, transaction histories, and behavioural patterns. Protecting this data from breaches and unauthorized access is paramount. Financial institutions must implement robust cybersecurity measures and comply with data protection regulations such as GDPR or CCPA. Failure to safeguard data not only risks financial loss but also undermines customer trust, which is critical in the finance sector.

Algorithmic Bias and Transparency

AI algorithms can inadvertently perpetuate or amplify existing biases present in training data. In the finance industry, biased models may result in unfair lending decisions, discriminatory credit scoring, or inequitable treatment of customers based on gender, ethnicity, or socioeconomic status. Ensuring transparency in AI decision-making processes is crucial. Institutions need to develop explainable AI models that regulators, customers, and stakeholders can understand and trust. Ethical AI practices involve regular audits, bias mitigation strategies, and inclusive data sets.

Regulatory Hurdles and Compliance Risks

The rapidly evolving landscape of AI technologies often outpaces current regulatory frameworks, creating uncertainty for financial institutions. Compliance with existing laws can be complex when AI models are opaque or continuously learning. Regulators worldwide are beginning to introduce specific guidelines for AI use in finance, focusing on accountability, risk management, and consumer protection. Institutions must proactively engage with regulators, maintain thorough documentation, and adopt best practices to navigate this challenging environment.

What Does the Future Hold for AI in Finance Industry Risk Management?

The ai finance industry is on the cusp of significant innovation, driven by emerging technologies and an increasing emphasis on workforce upskilling. These developments promise to reshape risk management practices and prepare finance professionals for a rapidly evolving landscape.

Emerging Trends: Explainable AI and Generative AI for Stress Testing

One of the key trends transforming risk management is the rise of explainable AI (XAI). Unlike traditional black-box models, XAI offers transparency by providing clear insights into how AI systems make decisions. This is crucial for risk management, where understanding the rationale behind predictions enhances trust, regulatory compliance, and ethical accountability.

Another innovative advancement is the application of generative AI for stress testing. By simulating a wide range of hypothetical market scenarios and economic conditions, generative AI helps institutions evaluate potential vulnerabilities more comprehensively. This proactive approach enables organizations to strengthen their resilience against unforeseen financial shocks.

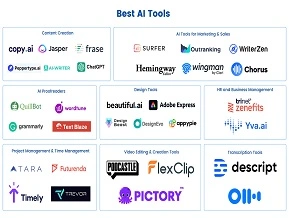

Role of AI Courses and Upskilling in the Finance Sector

As AI technologies become integral to financial operations, there is a growing need for professionals to develop new skills. AI-focused courses equip finance experts with knowledge of machine learning, data analytics, and AI ethics, enabling them to effectively leverage these tools for risk assessment and decision-making. Continuous upskilling fosters adaptability and innovation, essential qualities in the face of technological disruption.

How LAI is Preparing Professionals for the AI-Driven Future?

Learn Artificial Intelligence (LAI) is at the forefront of empowering finance professionals for this AI-driven future. Through hands-on training, real-world case studies, and expert mentorship, LAI helps finance practitioners stay ahead of industry trends and confidently implement AI solutions in risk management.

In summary, the future of AI in finance industry risk management lies in transparent technologies, advanced simulation tools, and comprehensive professional development—paving the way for smarter, more resilient financial institutions.

Conclusion

The ai finance industry is rapidly evolving, offering enhanced accuracy, faster decision-making, and stronger compliance in risk management. To stay competitive, financial professionals must embrace continuous learning and adopt AI-driven solutions. Understanding the intersection of finance industry and AI is essential for leveraging these advancements effectively. By investing in education and innovation, the finance sector can unlock AI’s full potential, paving the way for smarter, safer, and more efficient financial operations.

As AI continues to reshape the financial landscape, proactive adaptation will be the key to sustained success and resilience.