AI in Accounting Best Software Tools to Watch in 2025

What Does the Future Hold for AI in Accounting?

As artificial intelligence continues to transform industries, AI in accounting is becoming a cornerstone of modern financial management. From automating routine bookkeeping tasks to generating real-time financial insights, AI-powered tools are reshaping how accounting professionals operate. In 2025, businesses are expected to rely even more heavily on smart accounting platforms that offer machine learning, predictive analytics, and automated data processing. This blog post highlights the best software tools integrating AI to boost efficiency, accuracy, and decision-making in accounting. Whether you're a seasoned accountant or a business owner, staying informed about these tools is crucial for staying competitive in a digital-first financial landscape.

These emerging tools are not just about automation they’re about enabling smarter financial strategies. With features like AI-driven forecasting, anomaly detection, and natural language processing for reporting, today’s accounting software is evolving into an intelligent assistant for finance teams. As compliance requirements grow more complex and data volumes continue to rise, these AI solutions help reduce errors, increase transparency, and provide actionable insights. Adopting the right AI accounting software in 2025 can give businesses a significant edge, allowing professionals to focus more on strategic analysis and less on repetitive tasks.

Why AI in Accounting Is a Game Changer?

In recent years, AI has evolved from a futuristic concept to a practical necessity for modern finance teams. With automation, predictive analytics, and machine learning taking center stage, AI technologies are now integral to how businesses manage their financial data. The ability to process large volumes of transactions quickly and with fewer errors is transforming everything from bookkeeping to auditing.

Why Staying Updated with AI Tools Matters?

The accounting field is no longer static. New AI tools are emerging every year, offering better automation, improved accuracy, and enhanced decision-making capabilities. Professionals who keep up with these changes can leverage AI to improve their workflows and focus on higher-level strategic tasks rather than manual data entry. Failing to adopt new technologies can leave businesses lagging behind, relying on outdated systems that are inefficient and prone to error. By staying current with AI advancements, accountants and finance teams can enhance productivity, maintain compliance, and deliver more value to clients and stakeholders.

What It Means and Why It Matters?

The integration of AI in accounting is more than just a technological upgrade it represents a fundamental shift in how financial data is processed, analysed, and used to drive decisions. As artificial intelligence becomes more advanced, it enables accounting systems to move beyond manual input and rigid rule-based logic, offering smarter, faster, and more reliable ways to manage financial operations. This evolution is helping businesses reduce human error, enhance compliance, and uncover deeper financial insights. Understanding what AI brings to the table is essential for professionals who want to stay relevant and efficient in the rapidly changing world of finance.

Understanding the Role of AI in Accounting

At its core, AI refers to the use of artificial intelligence technologies such as machine learning, natural language processing, and predictive analytics to automate and enhance accounting processes. Unlike traditional systems that rely heavily on manual input and fixed rules, AI-powered tools can learn from data, adapt to patterns, and improve accuracy over time. This shift is revolutionizing the way accountants handle everything from data entry and invoice processing to auditing and financial forecasting.

Key Benefits of AI in Accounting

The integration of AI delivers several key benefits that are transforming the industry. One of the most impactful is automation, which allows repetitive tasks like bank reconciliation, invoice matching, and data classification to be completed without manual intervention freeing up valuable time for more strategic work. AI also significantly reduces human error by ensuring consistency and validating data in real time. Additionally, faster reporting becomes possible, as financial statements and analytics can be generated using real-time data, enabling quicker and more informed decisions. Perhaps most importantly, AI provides better insights through predictive analytics, helping businesses identify trends, assess risks, and uncover new opportunities for growth.

How Accounting and AI are Changing Financial Operations?

The fusion of accounting and AI is revolutionizing financial operations by introducing unprecedented levels of speed, accuracy, and intelligence into everyday processes. No longer limited to manual bookkeeping and static spreadsheets, accounting now involves AI-driven tools that automate repetitive tasks, analyse large datasets, and provide real-time insights. This shift is transforming the finance function from a back-office operation into a strategic powerhouse. As AI continues to integrate into accounting systems, businesses are experiencing streamlined workflows, reduced human error, and enhanced decision-making capabilities making financial management more proactive, agile, and future-ready than ever before.

Transforming Daily Workflows with Smart Automation

The integration of accounting and AI is reshaping how financial operations are managed on a daily basis. From automated data entry to intelligent invoice processing, AI is streamlining workflows and increasing efficiency across the board. Traditional accounting processes that were once time-consuming and prone to error are now being handled by intelligent systems that can analyse, categorize, and reconcile financial data with minimal human intervention.

Redefining Roles in the Accounting Profession

The rise of accounting and AI is also reshaping professional roles within the industry. Bookkeepers, once responsible for data entry and record keeping, are now managing AI tools that perform those tasks faster and more accurately. Their role is shifting toward quality control and insights interpretation. Auditors benefit from AI’s ability to scan massive datasets quickly and detect irregularities, enabling more effective and risk-focused audits. Likewise, financial analysts are leveraging AI-generated insights to enhance forecasting models and deliver deeper, real-time financial advice.

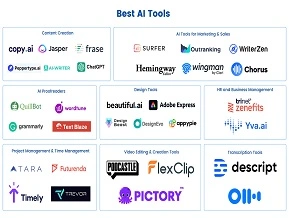

What are the Top AI-Powered Accounting Software Tools to Watch in 2025?

As the demand for smarter, faster, and more accurate financial tools grows, AI-powered accounting software is becoming a must-have for businesses of all sizes. These advanced platforms go beyond traditional bookkeeping by leveraging artificial intelligence to automate tasks, analyse data, and generate real-time insights. In 2025, leading tools like Xero and QuickBooks are setting the pace with innovative features such as smart reconciliation, predictive forecasting, intelligent categorization, and anomaly detection. By embracing these cutting-edge solutions, businesses can reduce errors, improve efficiency, and make more informed financial decisions keeping them ahead in a rapidly evolving digital economy.

Xero with AI Integration: Smarter Reconciliation and Forecasting

As one of the most trusted cloud-based accounting platforms, Xero continues to evolve by embedding artificial intelligence into its core functions. In 2025, Xero is expected to lead the way in AI-powered accounting software, particularly with its smart reconciliation features. These AI tools can automatically match transactions with bank statements, reducing the time and effort needed for manual verification. The platform also uses predictive analytics to help businesses forecast cash flow and monitor financial health in real time. This makes Xero a powerful choice for small to mid-sized businesses looking for efficiency and forward-thinking tools.

QuickBooks AI Enhancements: Intelligent Categorization and Error Detection

QuickBooks, a longstanding leader in accounting software, is doubling down on AI enhancements for 2025. Its AI-powered capabilities streamline expense categorization by learning from past entries and automatically assigning transactions to the appropriate categories. This not only minimizes human error but also ensures consistency in financial records. Additionally, QuickBooks leverages machine learning to detect anomalies in financial data, alerting users to potential errors or irregular activities that could signal fraud or mismanagement. These smart features make QuickBooks a top contender among AI-powered accounting platforms, especially for freelancers and small businesses that need automation without complexity.

How Do You Choose the Right AI Accounting Software for Your Needs?

With so many options available, selecting the right AI accounting software can feel overwhelming but the key lies in aligning the tool’s features with your specific business requirements. Whether you're a startup seeking basic automation or a large enterprise needing advanced analytics, understanding what each platform offers is essential. From automation capabilities and scalability to customer support and cost, the right software should not only meet your current needs but also grow with your business. Choosing wisely ensures improved efficiency, better financial insights, and a stronger return on investment in the evolving world of AI-driven accounting.

Key Features to Evaluate Before Making a Decision

When selecting the ideal AI accounting software, it’s essential to evaluate a range of features that align with your business goals and operational needs. Start by assessing the level of automation offered does the tool handle transaction matching, invoice processing, reporting, and categorization without constant human input? Scalability is another critical factor, especially for growing businesses. Choose software that can adapt as your data volume and team size increase.

Aligning Software with Industry-Specific Needs

Not all AI accounting software is created equal, and the right choice often depends on your specific industry. For example, retail businesses may prioritize inventory tracking and automated sales tax calculations, while service-based companies might need stronger invoicing and time-tracking tools. Construction firms could benefit from job costing features, while nonprofits often need fund accounting capabilities.

What are the Challenges and Considerations When Adopting AI in Accounting?

Adopting AI offers powerful advantages, from automating routine tasks to uncovering deeper financial insights through advanced data analysis. However, it also presents several important challenges and considerations that businesses must address to ensure a smooth and effective transition. While AI can significantly streamline financial processes, reduce human error, and enhance overall productivity, successful implementation involves more than just installing new software. It demands a strategic approach that includes thoughtful integration with existing systems, alignment with organizational goals, and a cultural shift within teams. Employees must be open to change, and leadership must invest in upskilling staff to work alongside AI effectively. Without careful planning and support, the adoption of AI may fall short of its potential or even disrupt established workflows.

System Integration and Compatibility Issues

One of the primary hurdles in adopting AI is integrating it with existing financial systems and workflows. Many organizations rely on legacy accounting software that may not support seamless AI integration. This can lead to compatibility issues, data migration concerns, and operational disruptions. Choosing AI tools that can communicate with your current infrastructure, or selecting platforms with robust APIs, is key to avoiding these issues and maintaining data consistency.

Workforce Readiness and Training

Another major consideration is ensuring that your team is prepared to use AI features effectively. While AI handles routine tasks, humans are still required to monitor results, interpret data, and make strategic decisions based on AI insights. Without proper training, employees may resist new technologies or underutilize the system’s capabilities. Upskilling your accounting staff through online courses or vendor-led training ensures they are confident and competent in using AI tools.

What Learning Opportunities Does LAI Offer to Help You Master AI in Accounting?

As the use of AI in accounting becomes more widespread, professionals and students alike must invest in continuous learning to stay relevant and competitive. With financial processes evolving rapidly through automation, predictive analytics, and intelligent reporting, understanding how to work with AI tools is essential. LAI (Learn Artificial Intelligence) recognizes this need and offers comprehensive online courses designed specifically to help learners master AI applications in the accounting world.

Courses Tailored to Real-World Accounting Challenges

LAI’s curriculum covers a broad range of topics including AI-driven bookkeeping, fraud detection, smart reconciliation, and financial forecasting. These courses combine theory with hands-on exercises, ensuring that learners can apply what they learn in real accounting scenarios. Each module is created by AI and finance experts who understand the demands of modern accounting workflows.

Flexible Learning for Every Skill Level

Whether you're an entry-level accountant or a seasoned finance professional, LAI provides flexible learning paths that allow you to learn at your own pace. With options for certifications, interactive assignments, and real-time support, LAI’s programs make it easy to build your skills around your schedule. By mastering AI through LAI’s expertly crafted courses, you can stay ahead of industry changes, boost your career potential, and become a strategic asset in any finance team. In a future where technology and accounting are increasingly intertwined, LAI gives you the knowledge and tools to lead confidently and effectively.

Conclusion

The rise of AI in accounting is transforming the financial landscape by automating routine tasks, enhancing accuracy, and enabling smarter decision-making. As we’ve explored, tools like Xero and QuickBooks are leading the charge, while platforms like LAI empower learners to adapt and thrive in this evolving environment. The synergy between accounting and AI will only grow stronger in 2025, redefining roles and improving workflows across industries. To stay competitive and future-ready, it’s essential to explore AI-powered tools and invest in continuous learning through trusted resources like LAI’s specialized training programs.