AI for Finance Industry: Key Benefits, Challenges, and Career Opportunities

What is AI for the Finance Industry?

AI for Finance Industry is reshaping how financial institutions operate, offering smarter, faster, and more secure ways to manage money, assess risk, and serve customers. It enables banks, insurers, investment firms, and finch start-ups to automate routine tasks, gain deep insights from data, and deliver highly personalized financial services. From detecting fraud in real time to optimizing trading strategies and enhancing customer support with AI-powered chatbots, artificial intelligence is transforming every corner of the financial landscape. What was once considered a futuristic innovation has now become a fundamental driver of competitiveness and innovation in today’s fast-paced and digitally driven financial ecosystem.

As AI tools continue to evolve, their ability to handle increasingly complex financial functions is expanding rapidly. Technologies such as machine learning, natural language processing, and predictive analytics are now being used to analyse customer behaviour, forecast market trends, and even assist with regulatory compliance. This allows financial institutions to not only react to market changes faster but also anticipate future scenarios and plan accordingly. The integration of AI also helps reduce operational costs, minimize errors, and improve transparency key factors in building long-term trust and customer loyalty in a competitive market.

Understanding AI in Financial Services

Artificial Intelligence (AI) refers to the simulation of human intelligence by machines that can learn, reason, and make decisions. In the financial services sector, AI enables systems to process massive datasets, identify patterns, and automate complex tasks with minimal human intervention. This includes applications such as fraud detection, customer service automation, portfolio management, and real-time credit scoring.

The Growing Importance of AI in Finance

The AI for Finance Industry is increasingly important as global financial systems deal with growing volumes of data, increasing security threats, and rising customer expectations. AI helps institutions stay competitive by offering predictive analytics, automating routine processes, and detecting fraud in real time.

How AI is Transforming the Finance Industry?

AI Finance Industry is experiencing rapid transformation as artificial intelligence continues to redefine how financial institutions operate, make decisions, and interact with customers. By harnessing the power of data and advanced algorithms, AI is streamlining complex processes, enabling real-time analysis, and providing actionable insights that were previously impossible to achieve. From enhancing security through intelligent fraud detection systems to optimizing investment strategies with predictive analytics, AI is driving innovation across every segment of the financial world. As the demand for speed, accuracy, and personalization increases, AI has become a crucial asset in delivering smarter services and maintaining a competitive edge in the evolving financial landscape.

Key Applications of AI in Finance

AI’s impact is most visible in its core applications such as fraud detection, algorithmic trading, and credit scoring. In fraud detection, AI algorithms analyse vast amounts of transaction data in real time to identify suspicious patterns and anomalies, helping reduce financial losses and protect customer accounts. These systems, powered by machine learning, continuously evolve by learning from new data, thereby improving their accuracy and responsiveness over time. In algorithmic trading, financial institutions and hedge funds leverage AI-driven platforms to execute high-frequency trades based on market data, sentiment analysis, and predictive modelling. These platforms can process and respond to market changes faster than human traders, leading to more efficient strategies and potentially higher returns.

Use Cases across Financial Sectors

In banking, AI powers chatbots for customer service, personal finance advisors, and loan approval systems. Banks also use AI to automate back-office operations and compliance tasks. In the insurance sector, AI improves claims processing, detects fraudulent claims, and enhances risk assessment models. Insurers use predictive analytics to offer personalized policies and pricing. In the investment industry, AI supports robo-advisors, portfolio management tools, and risk forecasting systems, helping firms deliver tailored investment strategies and optimize asset allocation.

What are the Key Benefits of AI for the Finance Industry?

AI for Finance Industry offers numerous advantages that are transforming traditional financial operations and redefining the way institutions deliver services. By leveraging advanced technologies like machine learning, natural language processing, and data analytics, financial organizations are not only streamlining internal processes but also making smarter, faster, and more personalized decisions. These AI-driven innovations are helping institutions reduce costs, mitigate risks, and meet rising customer expectations in an increasingly digital world. Below are two of the most impactful benefits reshaping the finance sector today.

Enhanced Efficiency and Automation

AI significantly improves operational efficiency by automating repetitive and time-consuming tasks such as data entry, compliance checks, and transaction processing. Through robotic process automation (RPA) and intelligent workflows, financial institutions can reduce manual errors, speed up operations, and free up human employees for more strategic roles. For example, AI-powered chatbots handle thousands of customer queries in real time, reducing wait times and improving satisfaction without overburdening customer service teams.

Improved Decision-Making with Predictive Analytics

One of the standout advantages of AI in the finance sector is its ability to enhance decision-making. Predictive analytics uses historical and real-time data to forecast trends, assess risk, and identify investment opportunities. Financial advisors, portfolio managers, and credit analysts can make faster, more informed decisions backed by data-driven insights. In risk management, AI helps institutions predict loan defaults, detect fraudulent transactions, and anticipate market fluctuations. This allows for proactive strategy adjustments and more personalized financial services. Additionally, AI tools can segment customers based on behaviour, enabling banks and insurers to tailor products and offers that align with specific needs and preferences.

What are the Major Challenges in the AI Finance Industry?

While the AI Finance Industry continues to revolutionize financial services with powerful tools for automation, prediction, and personalization, it also faces several critical challenges that organizations must carefully navigate. As adoption grows across banking, insurance, and investment sectors, so do concerns related to data protection, ethical use, and regulatory compliance. The integration of AI into core financial operations brings with it complex questions about fairness, transparency, and accountability. Institutions must strike a balance between innovation and responsibility to ensure that AI serves both business goals and public interest. Below are two of the most pressing challenges currently facing the industry:

Data Privacy and Regulatory Compliance

Financial institutions handle vast amounts of sensitive data, from personal identification information to financial transactions. As AI systems rely on this data to function effectively, ensuring its privacy and security is paramount. Stricter regulations such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks in other regions require firms to handle data responsibly and transparently.

Bias in AI Algorithms

AI models in finance are only as good as the data they’re trained on. When historical data contains biases such as disparities based on race, gender, or geography those biases can be perpetuated or even amplified by AI algorithms. This is particularly concerning in areas like credit scoring, loan approvals, and insurance underwriting, where biased outcomes can lead to discriminatory practices.

What AI Technologies are powering the Finance Industry?

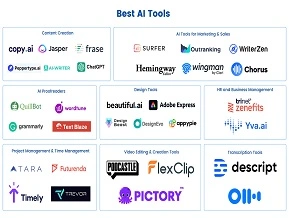

The AI Finance Industry relies on a range of advanced technologies that are dramatically transforming how financial institutions analyse data, make critical decisions, and interact with clients across various touch points. These tools are not just enhancing efficiency they’re reshaping the core infrastructure of finance itself. From machine learning models that forecast market trends to cloud computing platforms that enable real-time analytics and scalability, AI technologies are forming the backbone of digital transformation. By integrating these powerful tools, financial organizations can streamline operations, reduce costs, improve customer experiences, and stay competitive in an increasingly data-driven and fast-paced global economy.

Machine Learning, Natural Language Processing, and Computer Vision

At the core of financial AI systems is machine learning (ML), which allows computers to learn from vast datasets and improve over time without being explicitly programmed. In the finance industry, ML is used for credit scoring, fraud detection, customer segmentation, and predictive analytics. Natural Language Processing (NLP) enables financial platforms to understand and respond to human language. This technology powers AI chatbots, sentiment analysis tools, and voice-enabled banking, enhancing customer experience and automating communication.

Role of Big Data and Cloud Computing in AI Adoption

AI applications in finance would not be possible without big data. Financial institutions generate and collect massive volumes of structured and unstructured data from transactions, market feeds, customer interactions, and social media. Big data technologies help store, organize, and process this information at scale, enabling real-time analytics and AI-driven insights. Cloud computing supports scalable and flexible infrastructure for deploying AI models across the organization. Cloud platforms offer powerful computing resources, data storage, and integration tools that reduce operational costs and speed up AI implementation.

What are Some Real-World Examples of AI in the Finance Industry?

The AI Industry is rapidly evolving, with real-world implementations reshaping operations across both long-established financial institutions and cutting-edge finch startups. These use cases go beyond theory, demonstrating how artificial intelligence is actively transforming the financial ecosystem today. From streamlining internal processes to delivering hyper-personalized customer service, AI is being embedded into core functions at scale. These innovations are not only enhancing customer experiences but also driving down operational costs, reducing financial and compliance risks, and enabling faster, more data-driven decision-making. As a result, AI has become a strategic asset for organizations aiming to stay competitive in a fast-moving digital economy.

Case Studies from Top Financial Institutions

Major Banks and financial institutions have embraced AI to modernize their services. For instance, JPMorgan Chase uses a proprietary AI system called Coin (Contract Intelligence) to review legal documents reducing the time spent on mundane tasks from thousands of hours to just seconds. Similarly, Bank of America has introduced "Erica," an AI-powered virtual financial assistant that helps customers with balance inquiries, transaction searches, and budgeting tips through conversational AI.

Startups and Fintechs Leveraging AI Effectively

AI is also at the heart of innovation in the fintech world. Companies like Upstart are revolutionizing credit scoring by using machine learning models that consider alternative data such as education and employment history to approve loans more inclusively and accurately. Kensho, acquired by S&P Global, uses natural language processing (NLP) to turn complex financial data into clear, actionable insights, supporting decision-making for analysts and investors. Zest AI focuses on removing bias from lending decisions, helping financial institutions create fairer and more transparent credit models.

What are the Career Opportunities in the AI Finance Industry?

The AI Industry is not only transforming how financial services operate but also unlocking a wealth of exciting, high-demand career opportunities for professionals equipped with the right skill sets. As financial institutions increasingly integrate artificial intelligence into their operations across banking, insurance, investment management, and fintech startups the demand for AI-literate talent is growing at an unprecedented pace. This surge is driven by the need to design smarter algorithms, process massive volumes of data, and build intelligent systems that improve customer experiences and reduce risk.

In-Demand Roles in AI Finance

One of the most sought-after roles is the AI Engineer, responsible for designing and deploying machine learning models that power fraud detection systems, trading algorithms, and customer service bots. These professionals typically work closely with software developers and data teams to bring AI systems into production.

Skills and Educational Paths

To succeed in the AI Industry, a strong foundation in mathematics, statistics, and computer science is essential. Proficiency in programming languages like Python or R, along with experience in machine learning frameworks (such as TensorFlow or PyTorch), is highly valued. Knowledge of financial systems and regulatory compliance also adds a competitive edge.

Conclusion

The AI for Finance Industry is poised for even greater growth as technology continues to evolve and redefine financial services. From predictive analytics to real-time automation, the possibilities are vast and still unfolding. As the AI finance industry advances, professionals must prioritize continuous learning and upskilling to stay relevant in a rapidly changing landscape. Embracing AI not only improves operational efficiency but also fosters innovation and resilience in a competitive global market. The future of finance will be shaped by those who understand and leverage the power of artificial intelligence.