AI and Finance: How Artificial Intelligence Is Reshaping the Financial Industry?

What is the Intersection between AI and Finance?

The intersection between AI and finance represents the convergence of advanced artificial intelligence technologies with the financial industry’s complex and data-driven operations. This merging enables financial institutions to leverage AI’s capabilities—such as machine learning, natural language processing, and predictive analytics—to enhance decision-making, automate routine tasks, and improve customer experiences. By integrating AI into finance, companies can analyse vast amounts of data more accurately and efficiently than ever before, leading to better risk management, fraud detection, and personalized financial services. This powerful combination is reshaping how finance operates, driving innovation, efficiency, and competitiveness in an increasingly digital economy.

This intersection is not just about technology but also about transforming traditional financial processes. AI helps financial institutions respond quickly to market changes, optimize investment strategies, and comply with regulatory requirements more effectively. It also enables new business models, such as robo-advisors and AI-powered credit scoring, which democratize access to financial services. As AI continues to evolve, its role in finance will deepen, making it essential for professionals and organizations to understand and embrace this powerful synergy to stay competitive in the future financial landscape.

Brief Overview of AI Technology

AI encompasses several key technologies including machine learning, natural language processing, computer vision, and robotics. Machine learning, for instance, allows financial systems to recognize patterns and make predictions based on historical data. Natural language processing enables AI to understand and respond to human language, powering chatbots and virtual assistants in banking. These technologies combined empower financial institutions to handle complex operations more efficiently, reduce human error, and adapt quickly to market changes.

Why AI Matters in the Financial Sector?

The financial sector is data-intensive and highly competitive, making it an ideal candidate for AI adoption. AI helps banks, investment firms, and insurers improve customer experience by offering personalized services, detecting fraudulent activities faster, and managing risk more effectively. Moreover, AI-driven automation lowers operational costs by streamlining repetitive tasks like transaction processing and regulatory compliance. As a result, financial institutions can focus more on strategy and innovation.

What is Artificial Intelligence in finance?

Artificial Intelligence in finance refers to the application of advanced computational techniques that enable machines to perform tasks traditionally done by humans, such as analysing data, making predictions, and automating decisions. By combining finance and AI, institutions can process large volumes of financial data with greater speed and accuracy, uncover patterns, and improve outcomes in areas like risk management, fraud detection, and customer service. Technologies such as machine learning, natural language processing, and robotic process automation play a critical role in this transformation, helping to streamline operations and deliver smarter, more personalized financial solution.

Core AI Technologies Transforming Finance

Several core AI technologies are driving this transformation. Machine learning enables financial systems to learn from vast datasets and identify patterns that inform decision-making, such as credit risk assessment or stock price predictions. Natural language processing (NLP) allows AI systems to understand and process human language, powering applications like chatbots and automated customer service. Additionally, robotic process automation (RPA) uses AI-driven robots to handle repetitive tasks like transaction processing and regulatory reporting, freeing up human employees for more strategic work.

Examples of Finance and AI Applications

AI applications in finance are diverse and impactful. For instance, algorithmic trading uses AI to execute trades at high speed based on market data analysis. Fraud detection systems employ machine learning to identify unusual transaction patterns and prevent financial crimes. Robo-advisors provide personalized investment recommendations using AI algorithms, making wealth management more accessible. Moreover, AI-powered credit scoring models offer more accurate and fair assessments of loan applicants, improving financial inclusion.

How Finance and AI Work Together to Enhance Decision-Making?

Finance and AI work together to significantly improve decision-making by leveraging advanced data analysis and real-time insights. AI technologies process vast amounts of financial data to identify patterns, predict market trends, and provide accurate forecasts, enabling institutions to make informed, strategic decisions. Additionally, AI enhances risk management by continuously assessing potential threats and detecting fraudulent activities as they happen. This seamless integration of finance and AI leads to faster, more reliable decisions that improve operational efficiency and protect both organizations and their customers.

AI-Driven Data Analysis and Predictive Analytics

The collaboration between ai has revolutionized decision-making processes within financial institutions. One of the key ways this happens is through AI-driven data analysis. AI systems can process enormous amounts of financial data far more quickly and accurately than traditional methods. By leveraging machine learning algorithms, these systems detect patterns and trends that may not be obvious to human analysts. Predictive analytics, powered by AI, enables financial professionals to forecast market movements, customer behaviour, and economic shifts with higher precision. This foresight helps institutions make proactive, data-informed decisions, optimizing investment strategies and portfolio management.

Real-Time Risk Assessment and Fraud Detection

Another crucial area where finance intersect is in real-time risk assessment and fraud detection. Financial markets and institutions constantly face various risks, including credit risk, market volatility, and cyber security threats. AI technologies assess these risks continuously by analysing transaction data, market signals, and customer behaviour in real time. This immediate insight allows for rapid response to emerging threats, reducing potential losses and safeguarding assets. Additionally, AI-powered fraud detection systems use advanced pattern recognition to identify suspicious transactions and fraudulent activities that traditional systems might miss. These systems adapt and improve over time, learning from new fraud tactics to protect both institutions and customers effectively.

How are AI and Finance Used in Automated Trading and Investment Management?

AI and finance come together in automated trading and investment management to revolutionize how financial decisions are made. AI-powered systems, such as robo-advisors, use complex algorithms to analyse market data and investor preferences, creating personalized portfolios that adjust automatically to changing conditions. These technologies enable faster, more accurate trade executions and help reduce human biases in investment decisions. While AI-driven trading offers benefits like increased efficiency and cost savings, it also presents challenges such as managing risks associated with rapid market movements and ensuring transparency. Overall, the fusion of finance in this area is making investment management more accessible and efficient for a wide range of investors.

Robo-Advisors and Personalized Investment Portfolios

One of the most transformative applications of ai and finance is in automated trading and investment management. Robo-advisors, powered by AI algorithms, are reshaping the way individuals and institutions manage their investment portfolios. These digital platforms analyse a user’s financial goals, risk tolerance, and market data to create personalized investment strategies. By continuously monitoring market conditions, robo-advisors automatically rebalance portfolios and adjust asset allocations to optimize returns. This level of automation provides investors with affordable, data-driven advice that was previously available only through traditional financial advisors.

Benefits and Challenges of AI-Driven Trading Systems

AI-driven trading systems, often referred to as algorithmic or automated trading, use machine learning and advanced analytics to execute trades at high speeds and with greater precision. These systems can process massive datasets to identify trading opportunities that human traders might miss. Benefits include increased efficiency, reduced emotional bias, and the ability to react instantly to market changes. However, challenges remain, such as the risk of over fitting models to past data, the potential for market volatility triggered by automated trades, and concerns about transparency and regulatory compliance.

How Does the Integration of Finance and AI Improve Customer Experience?

The integration of AI is significantly enhancing customer experience by providing more personalized, efficient, and accessible financial services. AI technologies analyse individual customer data to deliver tailored banking advice and product recommendations, helping users make smarter financial decisions. Additionally, AI-powered chatbots and virtual assistants offer instant support around the clock, reducing wait times and improving service responsiveness. This seamless blend of finance not only streamlines routine interactions but also empowers financial institutions to better understand and meet customer needs, ultimately fostering greater satisfaction and loyalty.

Personalized Banking and Financial Advice through AI

The integration of finance and ai is transforming customer experience by enabling highly personalized banking and financial services. AI-powered systems analyse individual customer data, including spending habits, income, and financial goals, to deliver tailored advice and product recommendations. This personalization helps customers make better financial decisions, whether it’s choosing the right loan, investment plan, or budgeting strategy. Robo-advisors and AI-driven chatbots provide round-the-clock assistance, offering insights and support without the need for human intervention, making financial management more accessible and user-friendly.

Enhancing Accessibility and Efficiency in Customer Service

Beyond personalization, AI integration enhances accessibility and efficiency in customer service. Natural language processing (NLP) allows AI chatbots and virtual assistants to understand and respond to customer queries in real time, offering instant support on common issues such as account information, transaction history, or loan applications. This reduces wait times and improves overall satisfaction. Additionally, AI systems help financial institutions identify customer pain points and preferences through data analysis, allowing them to optimize service delivery. Automated processes also free up human agents to handle more complex tasks, ensuring customers receive prompt and effective assistance when needed.

What is AI’s Role in Risk Management and Compliance in Finance?

AI’s role in risk management and compliance in finance is becoming increasingly essential as financial institutions face growing regulatory demands and complex risks. AI technologies help automate compliance by monitoring transactions, identifying regulatory breaches, and generating accurate reports in real time. Machine learning models detect unusual patterns and flag suspicious behaviour, aiding in the early detection of fraud and financial crimes. By streamlining compliance and improving risk analysis, AI not only reduces operational costs but also enhances the accuracy and speed of regulatory processes, helping organizations maintain integrity and avoid penalties.

AI for Regulatory Compliance and Reporting

In today’s complex financial landscape, regulatory compliance is a critical challenge for institutions. AI plays a crucial role in automating compliance processes by continuously monitoring transactions, contracts, and communications to ensure adherence to regulations. Using natural language processing (NLP) and machine learning, AI systems can analyse large volumes of regulatory texts and identify relevant rules applicable to specific situations. This reduces the manual effort required for compliance reporting and helps financial institutions avoid costly penalties. AI also enables real-time compliance tracking, ensuring that firms remain up to date with ever-changing regulations.

Detecting Suspicious Activities with AI Tools

Another vital aspect of AI’s role in risk management and compliance in finance is its ability to detect suspicious and potentially fraudulent activities. AI-powered anomaly detection systems analyse transaction patterns and flag unusual behaviour that might indicate money laundering, insider trading, or other financial crimes. Unlike traditional rule-based systems, AI can adapt and learn from new data, improving its detection accuracy over time. This proactive approach helps financial institutions mitigate risks before they escalate, protecting both the company and its customers.

What are the Challenges and Ethical Considerations in AI and Finance?

The use of AI and finance together presents powerful opportunities—but also serious challenges and ethical concerns. One major issue is algorithmic bias, where AI systems trained on historical financial data may unintentionally discriminate against certain groups, leading to unfair lending decisions or credit evaluations. Another key concern is transparency. Many AI models, especially complex ones, operate like “black boxes,” making it difficult for institutions and consumers to understand how decisions are made. This lack of explainability can erode trust and create regulatory risks. Addressing these challenges requires financial institutions to prioritize fairness, accountability, and transparency in their AI implementations.

Bias and Fairness in AI Algorithms

As financial institutions increasingly rely on AI systems, one of the primary ethical concerns is algorithmic bias. AI models learn from historical data, which may reflect existing inequalities or discrimination in the financial system. This can lead to biased outcomes, such as denying loans or credit to certain demographic groups based on flawed or unbalanced data. Ensuring fairness in AI requires financial firms to carefully select training data, regularly audit models, and implement bias mitigation strategies. Without proper oversight, biased AI systems can undermine trust and reinforce systemic inequalities.

Transparency and Explain ability in AI Financial Models

Another major challenge in finance is the lack of transparency and explain ability in AI-driven decisions. Many advanced AI systems, especially deep learning models, function as "black boxes"—making predictions or decisions without offering clear explanations. In finance, where decisions can directly affect people’s lives and livelihoods, this lack of clarity can be problematic. Regulators and customers increasingly demand that institutions provide understandable justifications for AI-generated outcomes, especially in areas like lending, fraud detection, and investment recommendations. Developing explainable AI (XAI) models is crucial to maintaining accountability and trust in financial AI systems.

Conclusion

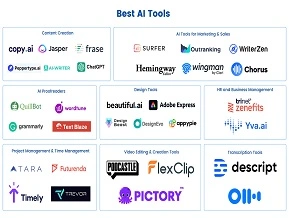

AI and finance are rapidly evolving together, reshaping how institutions manage investments, detect fraud, and serve customers. This powerful partnership is driving innovation and efficiency across the financial sector. As the demand for intelligent systems grows, understanding the role of finance and AI becomes essential for professionals aiming to stay competitive. By mastering AI tools and techniques, finance experts can unlock new career opportunities and lead digital transformation in their organizations. LAI’s expert-led online courses offer practical, accessible learning paths designed to help you thrive at the intersection of AI.