Accounting in AI Tools, Trends, and Technologies to Watch in 2025

How Has AI Evolved in the Field of Accounting?

AI and Accounting: A New Era Begins

The intersection of AI and accounting is ushering in a transformative era for the financial world. As artificial intelligence continues to advance, it is rapidly changing how businesses manage, record, and analyse their financial data. From automating routine bookkeeping tasks to providing deep insights through predictive analytics, AI is no longer a futuristic concept it’s an integral part of modern accounting systems. Traditional accounting relied heavily on manual data entry, spreadsheets reconciliations, and hours of number-crunching. Today, AI-powered tools can process vast amounts of data in real time, reducing human error and increasing efficiency. Accountants can now focus more on strategic decision-making, risk assessment, and advisory roles rather than repetitive administrative tasks.

Why Understanding AI Trends in 2025 Matters?

As we move into 2025, understanding how AI tools and trends will shape the accounting profession becomes crucial. Businesses that adopt AI-driven financial tools can gain a competitive edge by improving accuracy, reducing operational costs, and speeding up decision-making. For accounting professionals, staying updated on AI trends is essential to remain relevant in a rapidly evolving job market. Key AI technologies like machine learning, natural language processing, and robotic process automation are becoming standard features in leading accounting software. These innovations are expected to further disrupt traditional financial workflows and create new career paths for those with tech-savvy accounting skills.

The Shift towards Automation and Digital Finance

Globally, there is a growing emphasis on digital transformation across industries and accounting is no exception. The rapid advancement of technology, combined with increasing demands for efficiency and transparency, has driven both private and public sectors to rethink traditional financial practices. Governments, multinational corporations, and small to medium-sized enterprises (SMEs) are now heavily investing in cloud-based, AI-integrated financial solutions that can deliver faster processing, greater scalability, and enhanced data security. These smart systems are no longer optional add-ons but essential tools for staying competitive in a digital-first economy. Cloud accounting platforms powered by artificial intelligence offer real-time collaboration, automated compliance tracking, and instant data analysis, making them far more adaptable than legacy software. This shift is enabling finance teams to operate with greater agility, even in remote or hybrid work environments.

What is Accounting in AI?

Understanding the Basics of Accounting in AI

Accounting in AI refers to the use of artificial intelligence to automate, enhance, and streamline accounting processes. It combines traditional accounting practices with modern AI technologies to improve accuracy, speed, and decision-making in financial tasks. Rather than replacing accountants, AI works alongside them to handle time-consuming manual duties and uncover deeper insights from data. In simple terms, accounting in AI means using machines to "learn" from financial data and apply logic to perform tasks that previously required human effort. These tasks include categorising expenses, detecting anomalies, forecasting cash flows, and generating financial reports all with minimal manual input.

How AI is integrated into Accounting Functions?

AI is now embedded into many core accounting activities, transforming how financial tasks are performed. In bookkeeping, AI can automatically read invoices, match transactions, and update ledgers with minimal human input. For expense management, intelligent systems are capable of classifying spending, flagging inconsistencies, and even suggesting budget adjustments. In auditing and compliance, AI tools help auditors analyse large volumes of data quickly, making it easier to detect irregular patterns or signs of fraud. Tax preparation is also becoming more efficient, as AI can extract and organise financial data to streamline calculations and filings. Many of these applications rely on advanced technologies such as machine learning, natural language processing (NLP), and robotic process automation (RPA), which enable systems to learn from data, adapt to changing patterns, and improve accuracy over time.

How AI and Accounting Work Together in Modern Finance?

Transforming Financial Operations through AI

In today’s digital economy, the partnership between AI and accounting is revolutionising financial operations across industries.This powerful combination is enabling companies to automate complex processes, improve accuracy, and make data-driven decisions faster than ever before. One of the most visible changes is in bookkeeping, where AI tools automatically extract data from invoices, match transactions, and reconcile accounts eliminating hours of manual work. In auditing, AI systems analyse massive datasets to detect anomalies and flag potential fraud, dramatically increasing both speed and reliability. Tax filing is also streamlined, as AI can categorise expenses, apply the correct tax codes, and prepare reports in compliance with local regulations. Meanwhile, financial forecasting benefits from machine learning models that can identify patterns, predict cash flow trends, and guide investment decisions with a higher degree of confidence.

Smarter Financial Planning with AI

AI isn’t just helping with operational efficiency it’s also playing a critical role in enhancing financial planning and strategic decision-making. Modern AI-powered analytics tools can assess large volumes of real-time data from multiple internal and external sources, including sales figures, market trends, supply chain inputs, and even economic indicators. These tools generate actionable insights that help businesses make smarter, faster decisions about budgeting, resource allocation, investment opportunities, and financial risk management. With AI, financial planning becomes more dynamic and forward-looking. For example, machine learning models can detect subtle patterns and correlations in historical data that human analysts might overlook, uncovering emerging risks or untapped growth areas. CFOs and finance teams can now simulate a wide range of “what-if” economic scenarios such as market downturns, changes in interest rates, or supply chain disruptions and immediately see how those factors might affect revenue, profitability, or cash flow. This level of predictive capability significantly improves the accuracy of long-term financial planning and supports more resilient business strategies.

Redefining the Role of Accountants

As AI continues to take over routine tasks, the role of accountants and finance professionals is undergoing a significant transformation. Rather than spending their time on manual data entry, reconciliations, or basic compliance reporting, today’s professionals are stepping into more strategic and advisory roles. They are expected to work alongside AI systems — not just using them, but understanding how they function and how to interpret the insights they generate. This allows accountants to provide data-driven recommendations, identify financial trends, and support smarter decision-making at both operational and executive levels. In this new era, accountants are becoming key contributors to business strategy, helping organisations evaluate risks, optimise budgets, and plan for future growth.

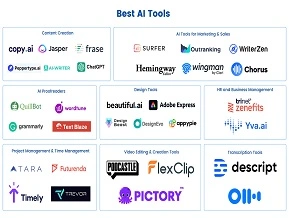

What are the Top AI Tools for Accounting in 2025?

Leading the Future of Finance with Smart Tools

As businesses seek smarter solutions to stay competitive and agile, accounting in AI is becoming a central force in reshaping financial management. Rather than relying on traditional software or manual workflows, companies are turning to innovative AI-driven tools that automate, streamline, and optimize core accounting functions. These advanced platforms are not just improving efficiency they’re revolutionizing how data is processed, interpreted, and used for decision-making. In 2025, a new generation of AI-powered accounting platforms is enabling businesses to handle everything from daily bookkeeping and invoice processing to complex tasks like financial forecasting and anomaly detection with unprecedented speed and accuracy. These tools use technologies likemachine learning, natural language processing, and predictive analytics to continuously learn from financial data and adapt to changing patterns over time. This means fewer errors, faster month-end closures, and better financial visibility across the board.

QuickBooks with AI Integration

QuickBooks continues to be a favorite among small to mid-sized businesses due to its user-friendly interface and robust feature set, and its AI-enhanced capabilities are making it more powerful and indispensable than ever before. The platform now leverages advanced machine learning algorithms to automatically categorise transactions, drastically reducing the time and errors associated with manual data entry. This automation allows business owners and accountants to focus on higher-value tasks rather than routine bookkeeping. Beyond transaction management, QuickBooks uses AI to predict cash flow trendsby analysing historical financial data alongside upcoming invoices and expenses. This predictive insight helps businesses anticipate potential shortfalls or surpluses, enabling smarter budgeting and financial planning. Additionally, the platform’s AI assistant provides real-time financial insights and notifications, such as automated reminders for overdue invoices or alerts about unusual spending patterns that might indicate errors or fraud.

Xero’s AI-Driven Capabilities

Xero, another major player in the cloud accounting space, has been steadily integrating AI technologies to enhance its platform’s capabilities and deliver smarter financial management solutions. With features like intelligent reconciliation, Xero automates the matching of bank transactions with invoices and receipts, significantly reducing manual effort and the risk of human error. Its invoice predictioncapabilities use machine learning to forecast when payments are likely to be received, helping businesses better manage their cash flow and plan accordingly. One of the standout AI features in Xero is its anomaly detection system, which actively scans financial data to identify irregularities or unusual transactions that could indicate errors, fraud, or compliance risks. This proactive approach helps businesses maintain financial accuracy and avoid costly mistakes. Xero’s smart algorithms also streamline everyday accounting tasks, making it easier for users to keep their accounts up to date without getting bogged down in administrative work.

What are the Emerging Trends in AI and Accounting?

The Rise of Predictive Analytics and Forecasting

In the evolving landscape of ai and accounting , predictive analytics is becoming a game-changer for businesses seeking to anticipate financial outcomes with greater accuracy. By leveraging historical data and advanced algorithms, predictive models help companies forecast cash flows, revenue trends, and potential risks. This trend allows finance teams to move beyond reactive accounting practices and adopt proactive strategies that improve budgeting and financial planning.

Natural Language Processing (NLP) Enhances Data Interpretation

Natural Language Processing (NLP) is another transformative trend in AI accounting tools. NLP enables systems to understand and interpret unstructured financial data, such as contracts, emails, and invoices, in human language. This capability accelerates data extraction and analysis, reducing manual effort and errors. For example, AI-powered systems can quickly summarise lengthy financial documents or flag discrepancies, making the accounting process faster and more accurate.

AI in Auditing: Continuous Audit Models

Traditional audits are often periodic and time-consuming, but AI is driving a shift toward continuous audit models. These AI-enabled audits analyse financial transactions and controls in real time, identifying irregularities and compliance issues as they happen. Continuous auditing enhances transparency and reduces the risk of fraud by providing up-to-date assurance on financial statements and operational activities.

Blockchain Integration for Transparency and Security

Blockchain technology is increasingly being integrated with AI to enhance accounting’s transparency and security. Blockchain’s immutable ledger combined with AI’s analytical power enables secure, verifiable, and real-time recording of financial transactions. This integration supports fraud prevention, audit readiness, and compliance, giving businesses and regulators greater confidence in financial reporting.

Which Technologies are driving the Future of Accounting in AI?

Machine Learning and Deep Learning in Accounting Software

The future is largely shaped by advances in machine learning and deep learning technologies. These techniques allow accounting software to analyze vast amounts of financial data, identify patterns, and improve over time without explicit programming. For instance, machine learning algorithms can detect anomalies that may indicate errors or fraud, while deep learning models enhance predictive accuracy for financial forecasting. This enables businesses to make more informed decisions based on data-driven insights.

Optical Character Recognition (OCR) for Receipt and Invoice Processing

OCR technology is revolutionizing how accounting systems handle paper-based documents. By converting printed or handwritten text on receipts and invoices into machine-readable data, OCR automates the traditionally manual process of data entry. This significantly reduces errors and speeds up transaction processing. Coupled with AI, OCR can also categorize and validate financial documents, making bookkeeping and auditing more efficient and reliable.

Robotic Process Automation (RPA) for Repetitive Accounting Tasks

RPA is a critical technology in automating repetitive and rule-based accounting tasks such as data entry, reconciliations, and report generation. By mimicking human actions within software applications, RPA bots perform these tasks faster and with greater accuracy. Integrating RPA with AI further enhances its capabilities by enabling bots to handle more complex processes, such as interpreting unstructured data and making decisions based on contextual information.

What are the Challenges and Ethical Considerations in AI and Accounting?

Data Privacy and Cybersecurity Risks

As ai and accounting become more intertwined, protecting sensitive financial data has become a critical challenge. AI systems often require access to large volumes of personal and corporate information, which increases the risk of data breaches and cyberattacks. Ensuring robust cyber security measures and compliance with data protection regulations like GDPR is essential to safeguard client confidentiality and maintain trust.

AI Bias in Financial Algorithms

One significant ethical concern is the potential for AI bias in financial algorithms. If the training data used to develop AI models contains historical biases or inaccuracies, the system may perpetuate unfair or discriminatory practices, such as biased credit risk assessments or audit judgments. It is crucial to implement rigorous testing and validation protocols to detect and mitigate bias, promoting fairness and equity in AI-driven accounting processes.

Regulatory and Compliance Concerns

The rapid adoption of AI tools in accounting raises important regulatory and compliance issues. Many jurisdictions are still developing clear frameworks for AI usage in financial reporting, auditing, and taxation. Businesses must navigate these evolving rules carefully to avoid legal penalties. Additionally, ensuring that AI systems comply with accounting standards and audit requirements remains a key priority for organizations and regulators alike.

How to Learn AI for Accounting?

Explore Online Courses on the LAI Platform

For those interested in mastering, the LAI (Learn Artificial Intelligence) platform offers a comprehensive range of online courses tailored to finance professionals. These courses cover foundational AI concepts, practical applications in accounting, and hands-on training with AI-powered accounting tools. Whether you are a beginner looking to understand AI basics or an experienced accountant aiming to implement automation technologies, LAI’s flexible learning options help you acquire the necessary skills at your own pace.

Certifications for AI in Finance

Earning industry-recognized certifications can enhance your credentials and demonstrate expertise in AI-driven accounting. Professional bodies like the AICPA (American Institute of CPAs) and ACCA (Association of Chartered Certified Accountants) now include AI-focused modules in their certification programs. These certifications often combine traditional accounting knowledge with AI applications, such as data analytics and machine learning in financial processes. Completing these programs not only boosts your career prospects but also equips you with the latest insights into regulatory and ethical considerations.

Conclusion:

Accounting in AI is rapidly reshaping the finance landscape through powerful tools, emerging trends, and innovative technologies. From AI-powered bookkeeping and auditing to predictive analytics and automation, the profession is evolving beyond traditional roles. This transformation offers exciting opportunities for accountants to become strategic advisors armed with advanced AI insights. As ai and accounting continue to integrate, staying updated through education and training is essential for building a future-ready career. Embracing AI learning today will empower finance professionals to lead and innovate in tomorrow’s digital economy.